27 Jul Toronto Condo Rental Market Watch – Q2 2023

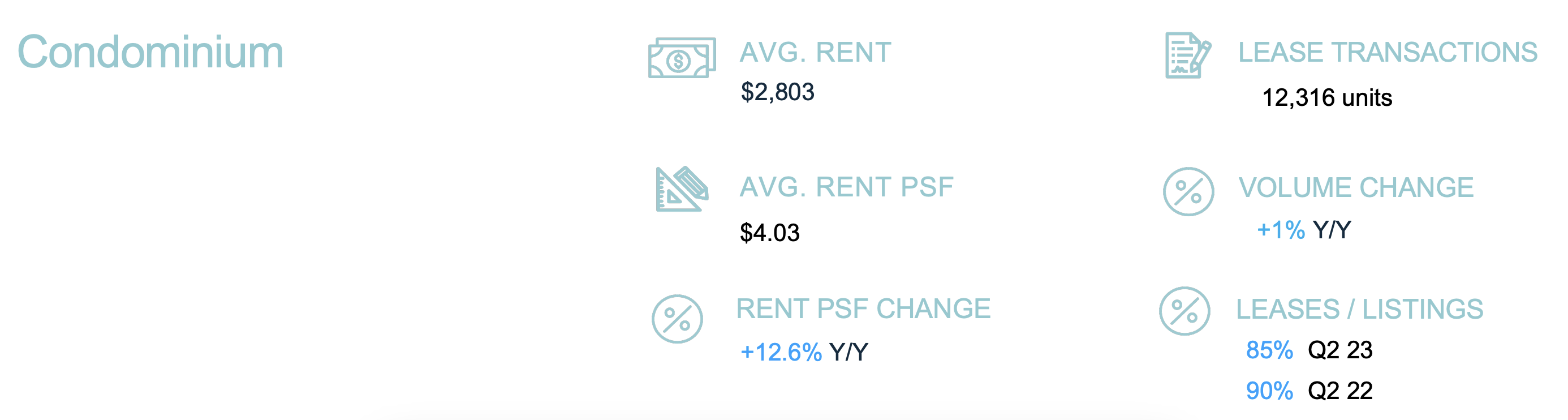

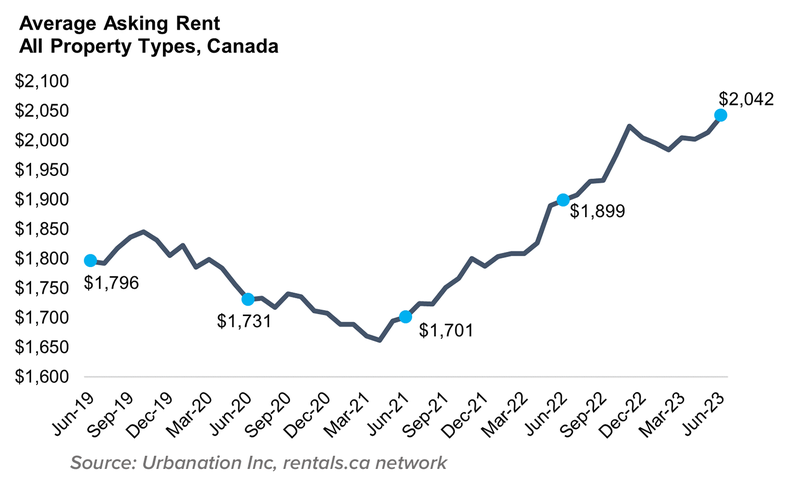

Rental growth continued around the GTA in Q2 2023 with the booming condominium market had double-digit rent inflation for the eighth straight quarter, reaching a record 12.6%. With rents skyrocketing, demand for smaller, less expensive homes has increased, creating an intriguing rental sector dynamic. Despite monthly losses and rising interest rates, investors held onto their units, encouraged by population expansion and a potentially positive market outlook. Despite rising demand, rental construction remained limited, keeping vacancy rates below 2%.

In Q2-2023, available units in newer purpose-built rental developments developed after 2005 had annual rent rise of 12.5%, with average rentals rising to $3.91 psf ($2,944 for 752 sf).

Q2 Saw Double-Digit Growth with Rental Units

In Q2-2023, condominium rentals rose 12.6% to $2,803, or $4.03 per square foot based on an average 695 sf unit size. The seventh consecutive quarter of double-digit rent inflation was slower than Q1-2023 (13.6%) and Q4-2022 (16.9%). Condo rents in the GTA rose 31.7% in two years.

Investors Hold Despite Losses

The real estate board leased a record 36.5% of the 17,542 newly built condominiums registered in the 12 months ending June 2023, up from 31.4% in 2022.

The 2023 Condo Investment Report by Urbanation and CIBC Economics found that most investors had negative cash flow because rents did not meet monthly ownership costs due to rising interest rates.

Due to strong rental market momentum and record high population growth, investors may have been motivated to hold onto their condominium rental units.

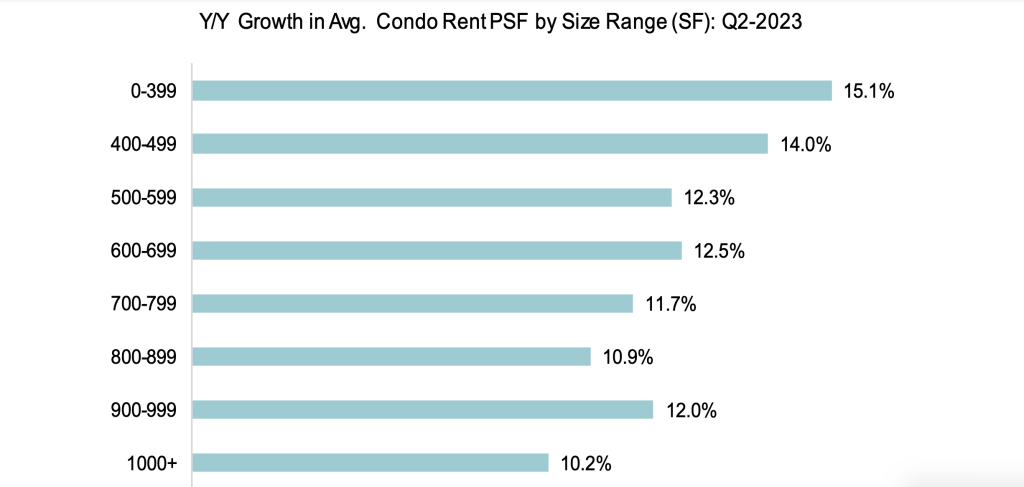

Smallest Units Show Fastest Rental Growth

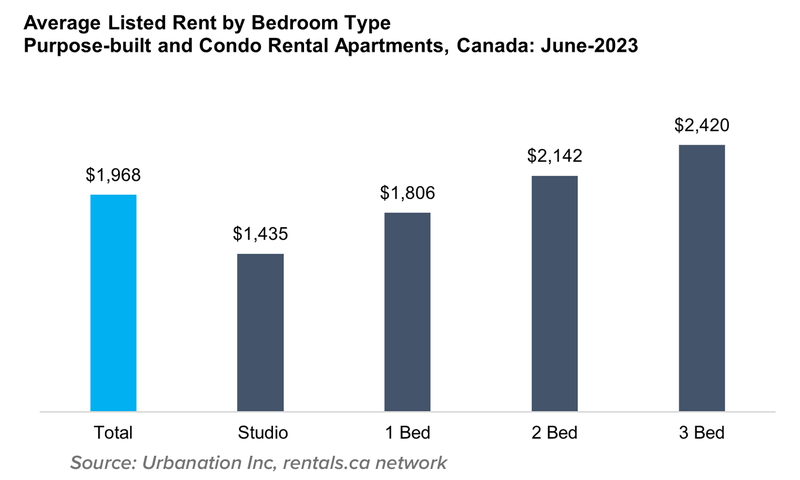

The ongoing demand for smaller, more inexpensive condos increased as GTA rents rose.

- Condos under 400 sf saw the fastest annual rent gain of 15.1%, hitting $2,121 monthly

- 400-499 square foot units had the second-fastest annual rent increase, 14.0%, to $2,309 monthly

- Rents for 1,000-square-foot or larger homes rose 10.2% annually to $3,991 monthly

Vacancy Rates Below 2% Limit Rental Construction

In Q2-2023, the vacancy rate in GTA purpose-built rental buildings completed since 2005 was 1.9%, up from 1.5% a year earlier but still below 2% for the sixth consecutive quarter.

Q2 had 19,263 GTA rental units under construction, down from the multi-decade high of 19,686 in Q1.

Among the 3,200 new rental units delivered over the past four quarters, a 57% share were leased during the period, edging up from a 56% absorption rate for newly delivered units in the period ending Q2-2022 and consistent with pre-pandemic absorption levels.

Only two purpose-built rental projects totalling 798 units began development in Q2, a 49% decrease from Q1-2023 (1,555 starts) and a 32% decrease from the quarterly average since 2018 (1,174 starts).

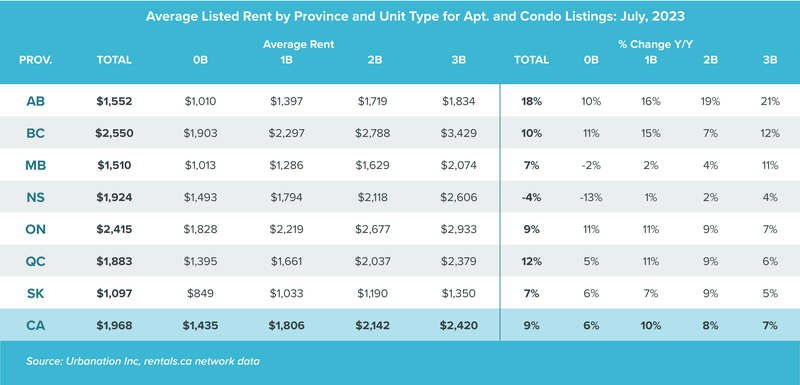

ONTARIO MARKET OVERVIEW

The annual rate of rent inflation was highest in the province of Albertain the month of July, however, in Toronto the average asking rent for purpose-built and condominium apartments jumped by 9%.

GTA MARKET OVERVIEW

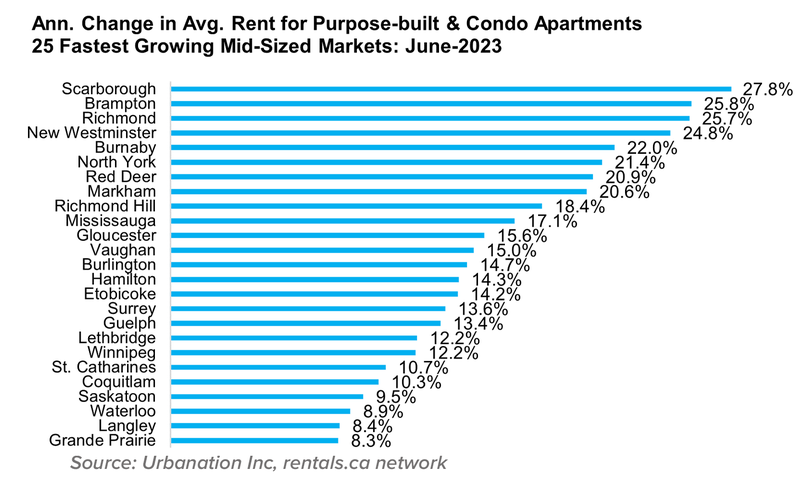

The ranks of the yearly rent growth for purpose-built and condominium apartments in Canada’s top markets remained the same from the previous month to the current month in the month of April.

The city of Toronto, second to only Calgary in annual rent growth, despite seeing yearly rent increases of 15.7%.

NOTABLE CHANGES

- Markets, like Scarborough and Brampton, lead the annual rent growth for June 2023

- Scarborough has seen annual rent growth of 27.8%

- Brampton has seen annual rent growth of 25.8%

- North York has seen annual growth of 21.4%

- Followed by Markham at a 20.6% annual growth

A LOOK FORWARD TO Q3 2023

Tenants, landlords, and investors face exciting difficulties and opportunities as the GTA rental market continues to rise. Condominium projects’ continued double-digit rent rise shows the region’s economic resiliency. Investors remaining steady despite monthly losses and rental demand skewed towards smaller units show the market’s adaptability and attractiveness to broad groups. However, the lack of rental units and construction activity poses potential worries. Stakeholders must stay watchful to capitalise on opportunities and overcome problems in the GTA’s dynamic rental market.

Read more about the rental market news on DelRentals and if you would like to speak to a DelRentals about listing your high-rise condominium as a rental, be sure to contact DelRentals today.

**Images courtesy of Rentals.ca and Urbanation

No Comments