14 Feb Toronto Condo Rental Market Update – February 2025

The Toronto condo rental market experienced significant shifts in 2024, with rising vacancy rates, fluctuating rental prices, and a record-breaking surge in new rental completions.

As the market adjusts to these changes, renters and landlords alike are navigating a more competitive landscape.

This market update provides an in-depth analysis of the latest trends, including rental price movements, supply increases, and construction news, helping both our investors understand the evolving dynamics of Toronto’s rental sector and look for opportunities to grow your portfolio.

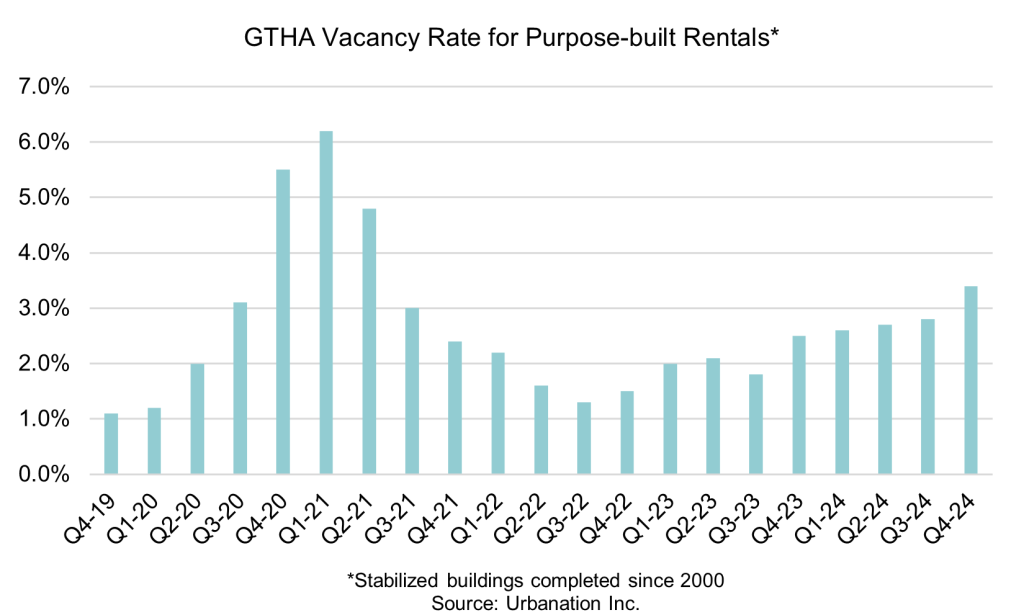

Vacancy Rates on the Rise in Toronto’s Rental Market

The Greater Toronto Area rental market saw a noticeable increase in vacancy rates in 2024, reaching 3.4% in Q4, up from 2.5% in the previous year. This marks the highest vacancy level since Q2-2021. The primary drivers of this trend have been high asking rents and more competition among landlords due to increased rental supply.

Rental Prices Reach Record Highs Despite Softening Demand

Rents for new purpose-built rental units available in Q4-2024 reached an all-time high for this quarter, averaging $4.09 per square foot (psf), with an average monthly rent of $2,967 for a 726-square-foot unit. This represents a modest 0.6% year-over-year increase and an 18.6% rise over the past five years.

While some rental categories saw price declines, three-bedroom units were an exception, with rents increasing by 4.8% to an average of $4.11 psf ($4,425 per month for a 1,077-square-foot unit). Conversely, one-bedroom apartment rents declined by 0.6% annually to $4.26 psf ($2,536 per month for 595 square feet), while two-bedroom rents saw a 1.7% increase to $3.84 psf ($3,327 per month for 865 square feet).

Surge in Rental Completions and Increased Competition

The supply of rental properties in the GTHA grew substantially in 2024. Purpose-built rental completions reached 5,537 units—a slight 4% decrease from 2023’s peak of 5,779 units but still 86% higher than the 10-year average of 2,977 units. Even more units are expected in 2025, with a record-high 8,872 purpose-built rentals scheduled for delivery.

Condominium completions soared to a record-breaking 29,800 units in 2024, with approximately half entering the rental market. This surge in supply resulted in a record-high number of condo leases, which grew by 29% compared to 2023. However, by the end of the year, active condo rental listings reached 5,646 units—a staggering 72% increase year-over-year.

Declining Condo Rents Amid Supply Growth

With the influx of available units, the average condo rental price fell 1.8% annually to $3.89 psf in Q4-2024, marking the third consecutive quarter of declines. On a monthly basis, the average rent dropped 4.7% to $2,682, its lowest level in 10 quarters.

Smaller condo units experienced the steepest declines in rent. Micro-units under 400 square feet saw a significant 9.0% annual rent drop, while 400-499 square-foot units declined by 6.0%, and 500-599 square-foot units fell by 4.8%. Meanwhile, larger units of 1,000 square feet or more maintained stable rental prices compared to the previous year.

Construction Starts Decline Amid Cost Challenges

Despite high rental demand, the cost pressures on developers have led to a slowdown in new rental construction. Purpose-built rental construction starts declined by 10% in 2024, totaling 5,960 units. The City of Toronto experienced an even sharper decline, with rental starts dropping 35% from 2023 to 3,534 units.

Looking Ahead: A Rare Window of Improved Affordability

The current softness in the Toronto rental market is primarily a result of the record-high completions seen in 2024. However, this increased supply is expected to be temporary as new condo and rental construction activity slows down. Renters are currently benefiting from improved affordability—a rare occurrence following years of rapid rent growth.

While rental prices remain historically high, the short-term outlook suggests a more balanced market with potential opportunities for renters seeking affordability in Toronto’s competitive housing landscape. For landlords and investors, the rising vacancy rates and increased rental supply may necessitate more strategic pricing and marketing approaches to attract tenants.

Sorry, the comment form is closed at this time.